About the Loan Guarantee Program

While not a bank, the BEDC will consider acting as a guarantor for a portion of a bank loan for small or medium sized businesses that appear viable and where the credit worthiness of the borrower is sound.

As guarantor of last resort, the BEDC can guarantee up to 75% of the agreed loan. The maximum guarantee amount is $300,000. Any small or medium sized business that has no other means of collateral (cash, real estate, equipment, vehicle chattel, inventory, etc.) may contact the BEDC and apply for a guarantee.

The following are all required when submitting an application for the loan guarantee program – A business plan, personal financial statement, financial/cash flow statements, bank statements and business references. Clients are also asked to submit any estimates listing goods to be purchased through the loan.

All applicants must have identification that demonstrates applicant is Bermudian.

As well as, the terms and conditions of your bank and a complete BEDC loan guarantee application form. There is an upfront non-refundable administration fee of $300 that will be applied towards the total Loan Guarantee Fee. A $50 upfront non-refundable Credit Check Fee is required per applicant and the

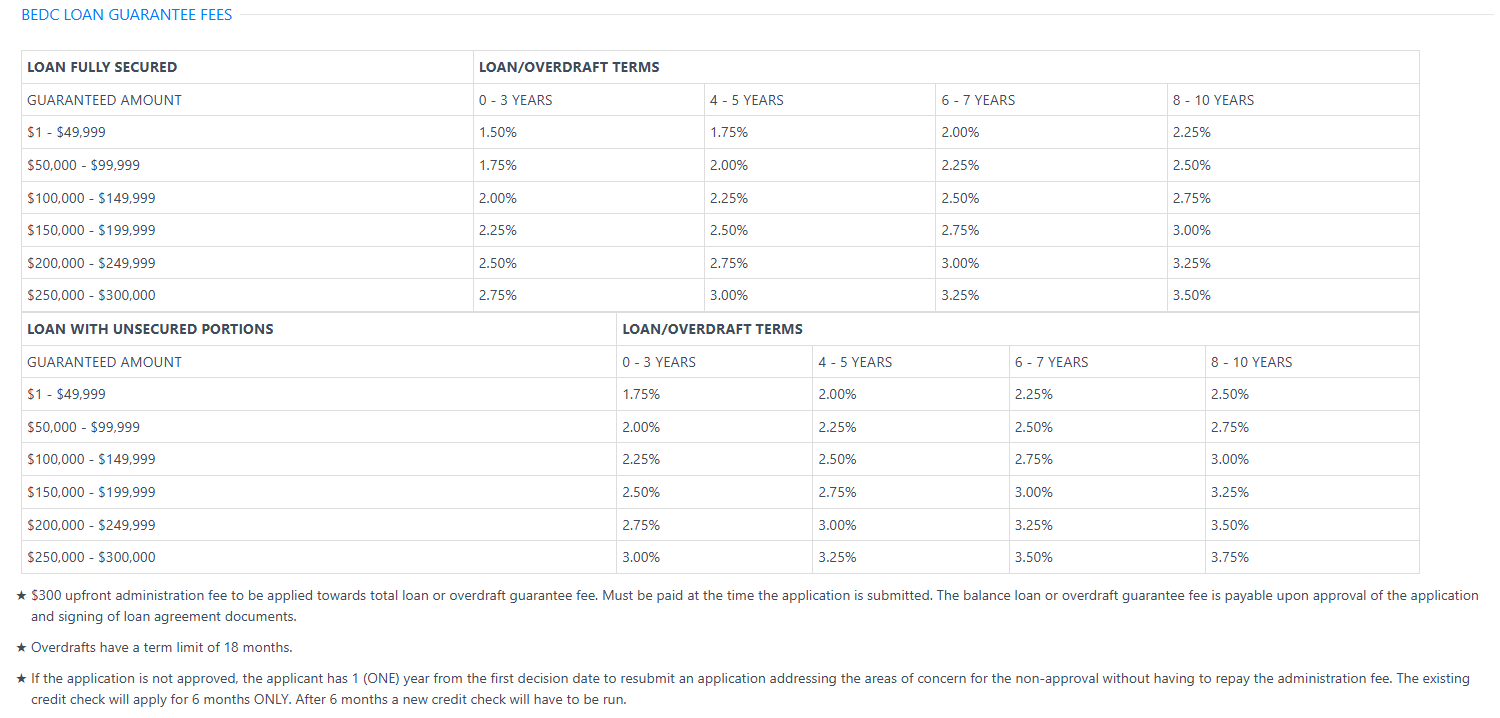

Loan Guarantee Fee is – Fees range from 1.5% to 3.25% depending on the loan amount and available security

75% Guaranteed

Repayment Terms

Approval

Penalty Rate

Credit Check

Processing

Processing Time

Interest Rate

Application Fee

The Loan Guarantee product is available to all small and medium businesses, island wide; including vendors and those businesses located in a designated Economic Empowerment Zone.

The BEDC defines a small business as Bermudian – owned and managed; operating locally; having an annual gross payroll not exceeding $500,000 or having annual sales revenues of less than $1,000,000.

The BEDC defines a medium-sized business as a Bermudian-owned & owner-operated business enterprise with at least three of the following attributes:

- Gross annual revenues between $1 million and $5 million

- Annual payroll between $500K and $2.5 million

- A minimum of 11 and a maximum of 50 employees

- In operation for a minimum of 10 years

- Net Assets of less than $2.5 million

Although open to all businesses who meet the criteria, the BEDC desires to expose Bermuda’s small business.

Please ensure that you have reviewed the checklist below and have all the necessary information needed to apply.Complete and compile all information below, BEFORE filling out the application.